Most 1099 forms must be sent to independent contractors by this date as well. 31 to send you your W-2 form reporting your 2022 earnings. 17, 2023: Deadline to pay the fourth-quarter estimated tax payment for tax year 2022. 10, 2023: Deadline for employees who earned more than $20 in tip income in December to report this income to their employers on Form 4070. The deadline for C-corp returns is typically the 15th day of the fourth month following the end of the corporation's fiscal year if the corporation operates on a fiscal year, rather than a calendar year.

31 to send you your W-2 form reporting your earnings.

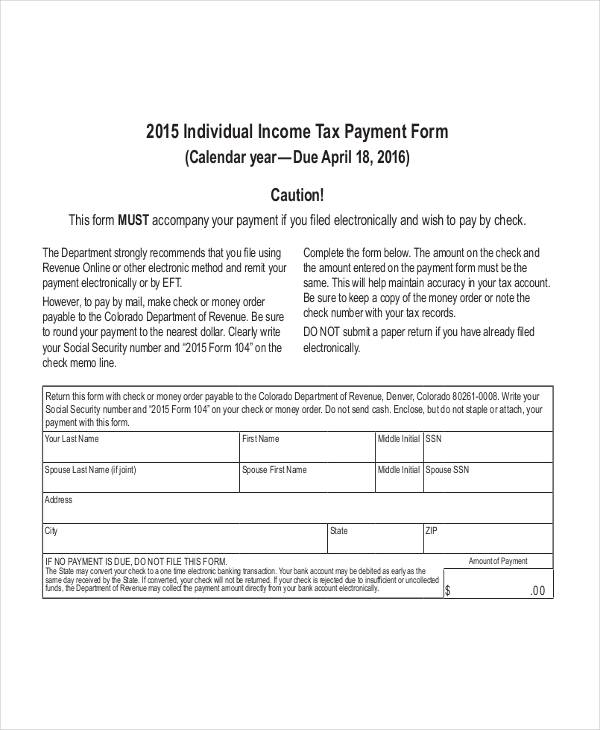

If they are not signed, they will be returned and will not be considered filed until the signed copy is returned to the income tax department. **All business tax returns MUST be signed. The Ashland City Tax Office will accept the same Federal 2% AGI (adjusted gross income) 2106 deduction only when complete and accurate documentation is provided. A six-month extension can be granted in any instance, if the correct Federal Extension Form is filed with our office by the due date of the return. Returns are due four months after the books are closed. If You're an Entity that Works on a Fiscal Year: Income Tax Returns are due April 15th of the following year after books are closed for entities that work on a calendar year.

0 kommentar(er)

0 kommentar(er)